ITR 2026 World Transfer Pricing Guide: Four CRA consultants recognized

CRA is proud to announce that Rebel Curd, David Kemp, Arin Mitra, and Anna Soubbotina have been acknowledged as “highly regarded” leaders in International Tax...

This website will offer limited functionality in this browser. We only support the recent versions of major browsers like Chrome, Firefox, Safari, and Edge.

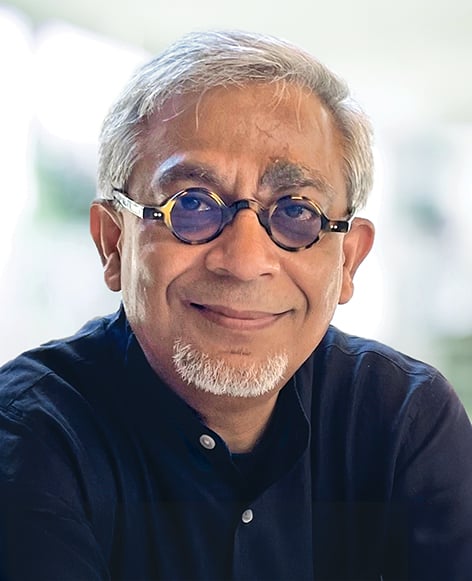

Dr. Arin Mitra, a financial economist and transfer pricing and tax valuation expert, is a vice president in the Transfer Pricing Practice. He has over 30 years of experience working with all facets of transfer pricing including planning, implementing, and defending transfer prices for large multinational corporations, primarily in the life sciences, technology, and branded consumer products industries.

Dr. Mitra has testified in litigation and has negotiated over 40 bilateral Advance Pricing Agreements (APA) involving the US, Japan, Australia, India, France, Switzerland, and Canada.

Dr. Mitra’s client advisory work focuses on the tax and non-tax aspects of transfer pricing, including the analysis of transfer prices for APA filings and negotiations, controversies primarily involving the valuation of intangible property (IP) for licensing and/or cost sharing transactions, including the treatment of synergies in acquisitions for IP valuations, and the bifurcation of routine versus non-routine intangible assets. Dr. Mitra’s expertise guides the analysis of joint investments in the context of integrated supply chains and the analysis of transactions between joint-venture partners.

Dr. Mitra advises on the design and implementation of co-promotion and/or co-development agreements between related parties. He also advises MNCs regarding the use of transfer pricing in performance management systems for effective management and control, ERP systems design and automation of SKU level price setting processes for tangible products and services, and coordinating customs valuation with transfer pricing considerations.

Dr. Mitra has been repeatedly named a top transfer pricing advisor by International Tax Review and Euromoney. He holds a PhD in Economics from Brown University and is a Fellow of The Institute of Chartered Accountants of India.