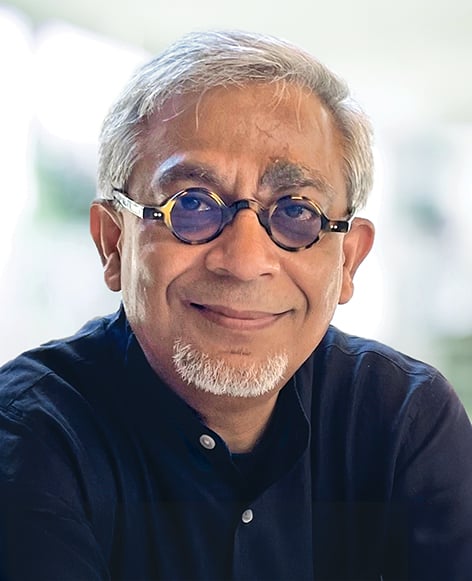

CRA is pleased to announce that Dr. Arin Mitra has joined CRA as a Vice President in the Transfer Pricing Practice.

“We are excited to welcome Arin to CRA,” said Paul Maleh, President and Chief Executive Officer of Charles River Associates. “He has more than three decades of experience with intercompany transactions and joins a growing and dynamic team committed to helping our clients with their most complex, cross-border tax issues.”

“Arin is recognized by his peers and industry publications as a top transfer pricing advisor,” said CRA Vice President and Transfer Pricing Practice Leader Rebel Curd. “In addition to providing expert testimony, he has managed large teams of tax professionals, advised multinational corporations on transfer pricing strategies and developed innovative software tools. We look forward to working with him on the most important and relevant transfer pricing and tax issues for multinational clients in all industries.”

Prior to joining CRA, Dr. Mitra worked for more than 30 years at a Big Four global tax compliance and advisory services firm, rising to the level of Lead Tax and Transfer Pricing Client Services Principal. His responsibilities included managing client engagements across the entire life cycle of transfer pricing, including planning, advance pricing agreements (APA), and the design and implementation of operational transfer pricing solutions. He also led economic analysis for more than 50 bilateral APAs involving the United States, Japan, Australia, India, Canada, and France.

Dr. Mitra holds a BCom in Accounting from Calcutta University, an MA in Economics from Jawaharlal Nehru University, and an MA and PhD in Economics from Brown University.

About CRA’s Transfer Pricing Practice

CRA’s Transfer Pricing Practice offers comprehensive, world-class functional, industry, and international expertise combined with rigorous economic and financial analysis to companies in all industries. Clients turn to CRA for the perspective and diverse set of skills required to assist in every phase of the tax cycle, including planning, documentation, and tax valuation. CRA’s experts also provide audit defense and support in litigation and alternative dispute resolution.