Indicators of change

These indicators help us track actions that could trigger direct political or regulatory intervention in wholesale electricity markets.

|

Customer cost impacts: Significant expected cost increases for customers.

|

||

|

Federal and state regulatory or legislative activity: Actions by state governors, state legislators, or state public utility commissions to review wholesale market design.

|

||

|

Degraded reliability: A declining reserve margin that can threaten electric reliability or indicate a wholesale market is not functioning properly.

|

||

|

Slow generation deployment: A market that cannot deploy new generation fast enough to meet projected load growth.

|

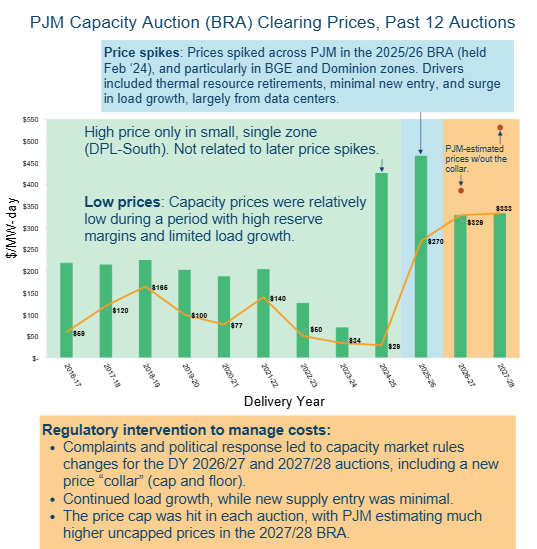

PJM capacity prices surged after an extended period of low prices, leading to significant attention and, ultimately, intervention

PJM’s recent capacity auction hit record prices while clearing short of the reliability requirement for the first time in history

Record high price (that could have been higher)

- The December 2025 capacity auction for DY 2027/28 cleared at the cap of $333/MW-day in each zone.

- PJM said the auction would have cleared at $523/MW-day without the “collar” (price cap and floor). Dominion would have been slightly higher.

Failure to achieve reliability target

- The BRA fell short of the resource adequacy requirement by 6.6 GW UCAP, amounting to a 14.8% installed reserve margin that was 5.2% below PJM’s 20% target.

- After the auction, PJM lowered the 2027/28 load forecast, reducing the expected capacity shortage.

Limited Supply Response

- Only ~350 MW UCAP of new capacity and ~425 MW UCAP from uprates was procured (out of a total of 134 GW).

How did we get here?

- Drastic load growth

- Limited new entry

- Resource retirements

Each of these drivers is addressed below.

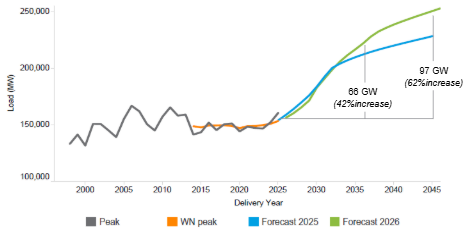

Load growth: Data center demand has driven a sharp increase in load forecasts, although forecasts are uncertain and constantly changing

PJM January 2026 load forecast

Summer Peak Demand (MW)

Compared to the 2025 forecast, PJM’s 2026 load forecast saw slightly lower peaks in near term, but higher peaks starting in mid-2030s.

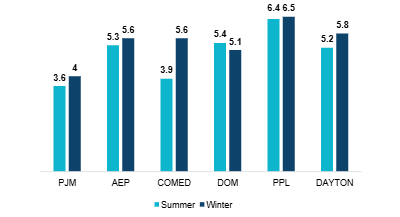

Data center load growth (%), 2026-2036

Load growth in PJM in the next 10 years is highly concentrated in a handful of load zones.

Source: PJM 2026 Load Forecast Report, Jan. 14, 2026

New entry: New resource entry has been slow in PJM due to rising capital costs, equipment backlogs, and delays in siting, permitting, and generator interconnection

Challenges to new entry – not expected to change in the near term

Increased capital costs + Equipment backlogs: Costs remain very high with no near-term signs of reductions and supply chains likely challenged for years to come.

Siting and permitting challenges: Some improvement at state levels but overall remains a challenge and federal solutions remain elusive.

Generator interconnection – delays: Significant improvements with recent reforms, but challenges remain.

Generator interconnection – costs: A ~1.5GW gas unit in the ATSI zone withdrew from the interconnection queue due to high estimated costs.

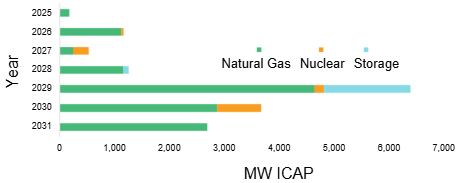

Recent and expected new entry of capacity

In 2025, only 2.1 GW of new generation came online. It was mostly solar, which carries lower accreditation ratings than thermal resources.

PJM’s Reliability Resource Initiative (RRI), which provides expedited interconnection for projects selected to meet resource adequacy needs, only identified <10 GW of new natural gas, nuclear, and storage capacity through 2031, and a large share was from uprates.

– In addition, ~6 GW of new natural gas plants are projected to enter by ~2029.

Near-term Additions of High Accreditation Resources through RRI (plus announced natural gas plants)

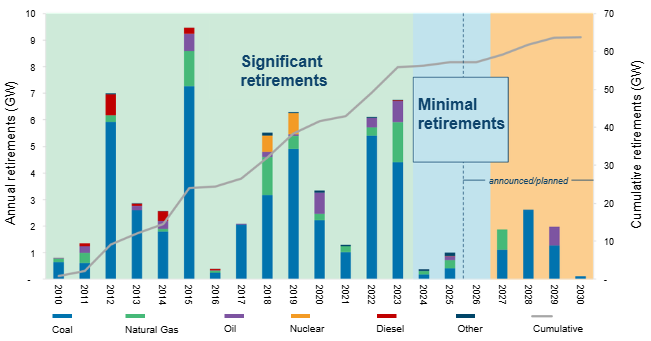

Retirements: Nearly 60 GW of thermal resources have retired in PJM since 2010, with future retirements uncertain due to possible policy/regulatory interventions

PJM Capacity Retirements, Historical and Forecast, 2010-2030

Source: PJM Generator Deactivation Data

- Significant retirements: Over a decade, PJM saw nearly 60 GW of retirements of older thermal resources due to economics (low natural gas prices, flat load, etc.) and environmental regulations.

- Minimal retirements: In recent years, retirements have slowed, mostly due to shifting economics and partly due to system needs (e.g.,“RMR units”).

Uncertain retirements: Looking forward, there are major planned retirements, but many are uncertain given pressures to remain online, including:

- Vastly improved economics (i.e., capacity prices)

- Shifting state policy in response to resource adequacy concerns

- Federal mandates, including DOE 202(c)

DOE use of 202(c) to delay retirements: The Dept. of Energy has increasingly used emergency authority under Section 202(c) of the Federal Power Act to delay retirements.

- Already used for the Eddystone unit in PJM

- Only lasts for 90 days, but DOE has extended multiple times and likely will continue to do so

- DOE likely to expand the use of 202(c) in PJM

Looking forward: Inevitable interventions to protect affordability

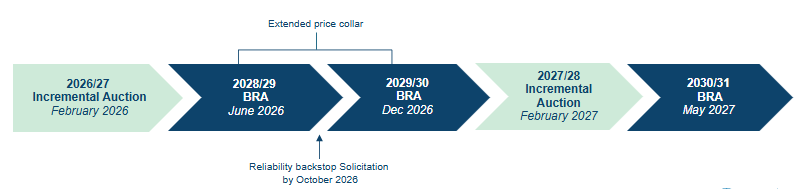

Upcoming capacity auctions

- The next BRAs will be in June 2026 (DY 2028/29) and December 2026 (DY 2029/30).

- PJM will extend the price collar for this auction, consistent with guidance from the White House and Governors (see next slide).

- Given this likelihood, further interventions in future auctions are inevitable to address electricity affordability and reliability concerns.

Interventions can take many forms. Each address capacity pricing and resource adequacy differently.

- Price controls – Caps on capacity prices, such as seen in the “collar” for the past 2 auctions. Not a solution to bring additional MW.

- Large load mandates – Requirements for new loads to receive interconnection and/or full grid services (such as capacity provision). One example is “Bring Your Own Generation” requirements.

- State policy/regulation – Subsidies for new capacity at scale, support for utility-provided solutions, contracts for new entrants, etc.

- Separate pricing for new entry – Moving away from single-clearing price auctions that pay the marginal capacity price to all resources.

- Matching large loads with new capacity – As outlined by the White House and PJM governors.

BRA schedule, highlighting several near-term interventions

Driven by affordability concerns, the White House and Governors directed PJM to hold a reliability backstop solicitation and extend the offer cap

Outline of the White House and Governor Intervention

On January 16, 2026, the White House announced a bipartisan Statement of Principles signed by the governors of 13 states in PJM and the Secretaries of Energy and Interior. The goal is to build new generation for data centers while ensuring affordability for non-data center customers.8

Further, the Statement directs PJM to:

– Hold a reliability backstop solicitation for new capacity to serve data centers. The solicitation must be held before October 2026 and have a 15-year tenor. Solicitation costs are to be first allocated to utilities with data centers, with any remaining costs allocated to utilities that are short capacity.

– Extend the price cap, which was set to expire, for an additional two auctions (the 2028/29 and 2029/30 BRAs) to protect retail customers.

– Accelerate generator interconnection, improve large load forecasts, and reform the capacity market to “ensure long-term viability” before the 2030/31 BRA, scheduled for May 2027, at which point “normal” BRAs return.

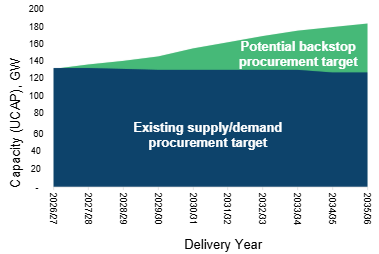

Potential target for PJM’s 2026 Reliability Backstop Solicitation (as presented by PJM)

Reliability Backstop Solicitation and impact on PJM’s future capacity market

While there is significant potential for the backstop solicitation to contribute to a solution, it remains to be designed and it carries significant uncertainty for participation levels, impact on capacity prices, and other outcomes going forward.