Indicators of change

Key indicators suggest that focus on affordability has intensified:

|

Regulatory signals: New affordability-focused dockets, shifts in commission language, expanded prudence reviews, and changes in approval timelines.

|

||

|

Legislative activity: Bills or executive actions targeting ratemaking, capital recovery, earnings limits, or utility spending.

|

||

|

Rate case outcomes: Disallowances, deferrals, changes to riders or trackers, and evolving expectations for spending discipline. |

Affordability debate focuses on national price averages

Recent studies report that, on average, American utility rates are up sharply in the past few years. Polling indicates that most customers are concerned about their bills and feel “powerless” in the face of rate increases. Commentary abounds that an affordability crisis is upon us, or soon will be, and that dire consequences could soon follow.

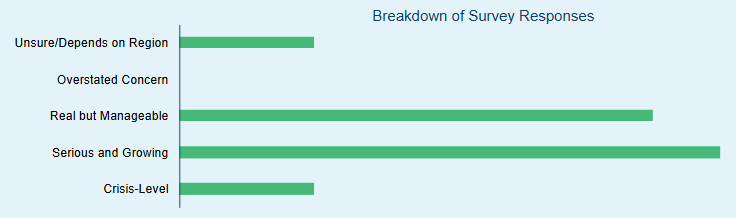

Affordability has become a dominant theme in utility and regulatory discussions, often cited alongside reliability as a top public concern. In your view, how would you characterize the current narrative around affordability in the power sector?

Rate trends more nuanced than narratives suggest

In a report prepared for the Edison Electric Institute (EEI), we analyzed the recent trends in retail electric rates.

Key findings from the study:

– Prevailing narratives that there is a broad national trend of rapidly rising electricity rates are inaccurate or incomplete. Trends that use national averages can be misleading because those data obscure important differences among the different rates that comprise the average.

– Trends in the nationwide average are heavily influenced by large rate increases in specific areas, including in the Northeast and California, and in those jurisdictions, data centers were not the cause of such rate increases.

– Going forward, utilities and their state regulators have committed to protecting retail customers from rate increases caused by new data centers. The protections being embedded in new tariffs and ratemaking measures are designed to prevent subsidies from existing ratepayers, help maintain utilities’ creditworthiness, and may put downward pressure on existing customers’ retail rates.

Click here to download the report

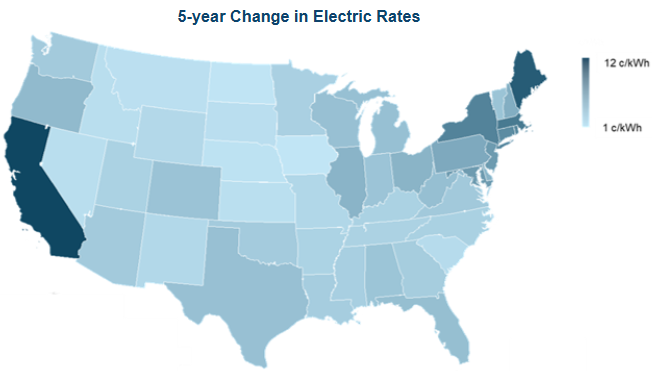

Local conditions drive affordability trends

The report found that trends in the nationwide average were heavily influenced by large rate increases in specific areas, as seen in the visual. Most other places experienced fairly stable rates, where rates increased either more slowly than inflation or at about the same rate.

| Level of concern | Region | |

| High |

California, where spending on wildfires has been a primary driver of a large increase in retail electric rates in recent years

|

|

| Mid/high |

The Northeast US, particularly New York and New England, where increases in wholesale electric costs passed through in states where utilities do not own generation have increased rates considerably |

New data center tariffs insulate customers from service costs

In both the Northeast and California, rate increases were not caused by data centers. Regardless, there have been observable actions taken by utilities to implement new tariffs and agreement to protect existing customers across the US. Fundamental to these tariffs and agreements is the requirement that new large loads fully or substantially fund the new generation, transmission, and other upgrades needed to serve them. The large loads are also required to pay for the studies to determine any upgrades. The tariffs and agreements generally ensure that utilities can recover their costs, including a rate of return, from the infrastructure they own and operate to serve new large loads. These retail provisions protect customers from paying the costs of building energy infrastructure to serve new large loads, ensuring that the incremental costs to serve large loads are borne by the large loads themselves, which prevents cost shifts to a utility’s existing customers.

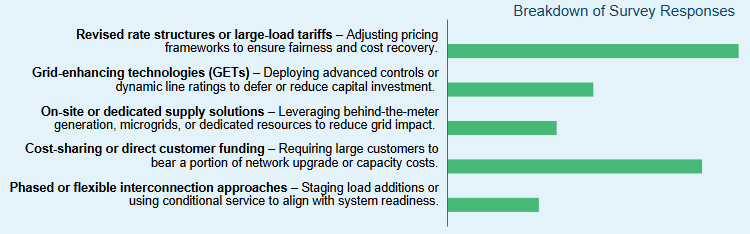

Our survey also found that the most effective way to protect ratepayers would be with revised rate structures/large-load tariffs or other cost-sharing mechanisms.

Data center growth is accelerating across multiple regions, creating both opportunity and pressure on system planning and customer costs. Which strategies are prioritized by your organization to manage large-load growth while protecting existing ratepayers?

Effective utility managers are finding opportunities to actively navigate a landscape in which affordability is increasingly prioritized. The most successful generally share a handful of best practices.

Recognize risk

IOUs are not in a business-as-usual environment. Diagnosing the situation and pivoting to effective strategy is critical.

> Observable utility best practices: Affordability risk is increasingly treated as a standing factor in regulatory proceedings, and the outlook often shows up not only in testimony but also in planning assumptions and internal decision screens.

Understand local dynamics

All relevant dynamics are local. Each IOU should understand what its rates have done, why its costs have changed, and how each of those trends vary from reported metrics.

> Observable utility best practices: Utilities frequently build a local affordability fact base (rates, cost drivers, bill impacts, and customer segmentation) to distinguish what is truly local from broader narratives that dominate public discourse.

Communicate and educate

Engage early and often with regulators, policymakers, and stakeholders. Help them understand the local situation and what the IOU is doing to serve customers and control costs.

> Observable utility best practices: Stakeholder engagement is often structured around education rather than advocacy—walkthroughs of bills, tradeoffs, and scenarios are used to align on the local context before positions harden.

Be proactive

Bringing the conversation to constituents creates a tremendous advantage. Be prepared to invest, operate, and manage the business different.

> Observable utility best practices: Affordability risk is increasingly treated as a standing factor in regulatory proceedings, and the outlook often shows up not only in testimony but also in planning assumptions and internal decision screens.